Are you navigating the complex world of finance, seeking clarity on where to entrust your hard-earned capital? Understanding the institutions that safeguard and grow your wealth is paramount, and a key player in this arena is JPMorgan Chase & Co. (JPMC), a financial behemoth offering a spectrum of services, each governed by specific entities and policies.

For individuals and institutions alike, grasping the distinctions between these offerings is crucial for making informed decisions. Within the JPMC ecosystem, various entities cater to distinct financial needs. For instance, in the United States, everyday banking needs like checking, savings, and lending are handled by JPMorgan Chase Bank, N.A. However, when it comes to navigating the complexities of the investment world, the landscape shifts. Other investment products and services, such as brokerage and advisory accounts, are offered through J.P. Morgan Securities LLC (JPMS), a member of key regulatory bodies. Understanding these nuances is not just about knowing where to deposit your paycheck; it's about strategically positioning your assets for growth and security.

| Category | Details |

|---|---|

| Name | JPMorgan Chase & Co. (JPMC) |

| Type | Financial Services Conglomerate |

| Headquarters | New York City, New York, USA |

| Key Subsidiaries | JPMorgan Chase Bank, N.A.; J.P. Morgan Securities LLC (JPMS) |

| Services Offered | Banking, investment management, asset management, private banking, securities services. |

| Bank Deposit Accounts & Lending (U.S.) | Offered by JPMorgan Chase Bank, N.A. (checking, savings, loans) |

| Investment Products & Services | Offered through J.P. Morgan Securities LLC (JPMS), including brokerage & advisory accounts. |

| Affiliates | Collectively referred to as "JPMCB," offer investment products including bank managed investment accounts and custody services. |

| Website | JPMorgan Chase Official Website |

The interplay between JPMorgan Chase Bank, N.A. and J.P. Morgan Securities LLC (JPMS) is vital to comprehend. While the former provides the bedrock of traditional banking services, the latter opens doors to a broader spectrum of investment opportunities. JPMS, as a member of regulatory organizations, operates under stringent guidelines designed to protect investors. This distinction is important because the level of risk and the regulatory oversight differ significantly between deposit accounts and investment products. For example, deposit accounts are typically insured, providing a safety net for depositors. Investments, however, carry market risk, including the potential loss of principal, and there's no guarantee that investment objectives will be achieved. Thus, while JPMorgan Chase Bank, N.A. safeguards your accessible funds, JPMS aims to grow your wealth through strategic investments. This is why "Other investment products and services, such as brokerage and advisory accounts, are offered through j.p. Morgan securities llc (jpms), a member of" is so crucial.

Furthermore, understanding the JPMC ecosystem extends beyond simply differentiating between the bank and the securities arm. JPMorgan Chase & Co., along with its affiliates (collectively known as "JPMCB"), provides a comprehensive suite of investment products. These offerings may include bank-managed investment accounts and custody services, catering to clients seeking a more hands-on, managed approach to their investments. This holistic approach allows clients to consolidate their financial needs under one umbrella, benefiting from the expertise and resources of the entire JPMC organization. However, it's crucial to remember that each service is governed by its own set of terms, conditions, and risk factors.

Navigating the digital landscape also requires a discerning eye. Its essential to recognize that JPMorgans website and mobile terms, privacy, and security policies may not extend to third-party sites or apps you are directed to. Always review the specific terms, privacy policies, and security measures of any site or app before sharing your information or engaging in any transactions. This proactive approach is crucial for protecting your personal and financial data in an increasingly interconnected world. The firm's advice is simple: "Please review its terms, privacy and security policies to see how they apply to you."

The relationship between JPMorgan Chase Bank, N.A. and its affiliates, particularly in the context of wealth management, is a key aspect of their service offerings. JPMorgan Private Client, for example, represents a banking and client service offering of JPMorgan Chase Bank, N.A., providing clients with access to investment services from J.P. Morgan. This interconnectedness allows clients to seamlessly integrate their banking and investment needs, benefiting from a coordinated approach to wealth management. However, it's crucial to recognize that even within this integrated framework, each service operates under its own set of guidelines and risk disclosures. A Private Client advisor should be able to fully explain these nuances to help the customer make an informed decision.

- Emma Anthurium Care Grow Like An Actress Plant Tips More

- Steven Evans Fishing Tips Charters The Pros Secrets

Consider the implications of investing through JPMS. As a registered broker-dealer, JPMS adheres to strict regulatory requirements designed to protect investors. This includes providing clear and transparent information about investment products, disclosing potential risks, and ensuring that investment recommendations are suitable for the client's individual circumstances. However, even with these safeguards in place, investing inherently involves risk. Market fluctuations, economic downturns, and unforeseen events can all impact investment performance. As a result, it's essential to approach investing with a clear understanding of your risk tolerance and investment goals. Therefore, "Investing involves market risk, including possible loss of principal, and there is no guarantee that investment objectives will be achieved."

The sheer scale and complexity of JPMorgan Chase & Co.'s operations highlight the importance of seeking personalized financial advice. A qualified financial advisor can help you navigate the intricacies of the JPMC ecosystem, assess your individual needs, and develop a customized investment strategy. They can also provide ongoing support and guidance, helping you stay on track toward your financial goals. Remember, financial planning is not a one-size-fits-all approach. It requires a deep understanding of your unique circumstances, risk tolerance, and long-term aspirations. An advisor can bring that level of expertise to bear.

Furthermore, be mindful of the evolving regulatory landscape. Financial regulations are constantly evolving, and it's important to stay informed about changes that could impact your investments. JPMorgan Chase & Co. is subject to a wide range of regulations, both at the federal and state level. These regulations are designed to promote transparency, protect investors, and maintain the integrity of the financial markets. By staying informed about these regulations, you can better understand the context in which JPMC operates and make more informed investment decisions. Regulatory scrutiny can be your friend if it keeps financial companies accountable for what they offer.

Ultimately, making informed financial decisions requires a proactive approach. Don't hesitate to ask questions, seek clarification, and conduct your own research. The more you understand about the institutions you entrust with your money, the better equipped you'll be to navigate the complexities of the financial world and achieve your financial goals. Whether you're opening a checking account with JPMorgan Chase Bank, N.A. or exploring investment opportunities through JPMS, a well-informed decision is always the best decision. This means understanding the differences between having "In the united states, bank deposit accounts and related services, such as checking, savings and bank lending, are offered by jpmorgan chase bank, n.a." and using other services.

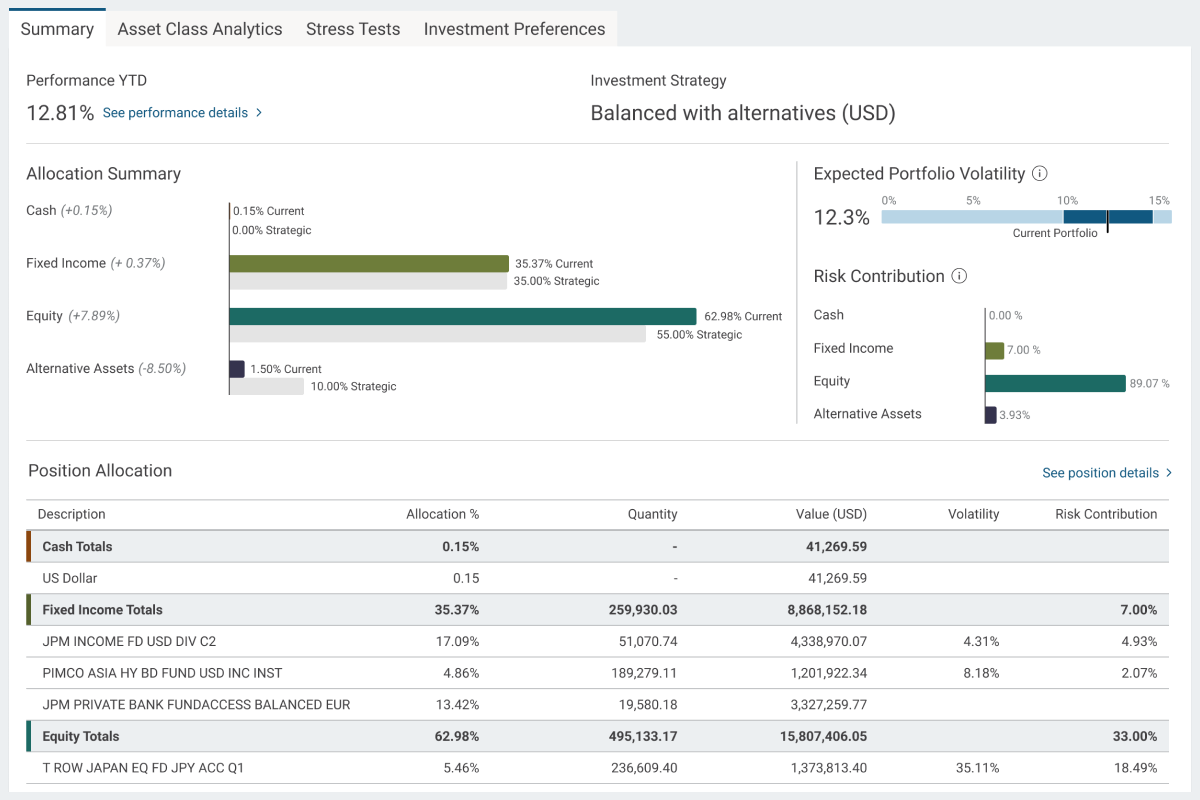

Diversification remains a cornerstone of sound investment strategy. Spreading your investments across different asset classes, industries, and geographic regions can help mitigate risk and enhance returns. JPMorgan Chase & Co., through its various entities, offers a wide range of investment options, allowing you to diversify your portfolio according to your individual needs and preferences. However, remember that diversification does not guarantee profits or protect against losses in a declining market. It's simply a tool for managing risk and improving the odds of long-term success.

The role of technology in financial services is undeniable. JPMorgan Chase & Co. has invested heavily in technology to enhance its services, improve efficiency, and provide clients with a more seamless experience. From online banking to mobile trading platforms, technology has transformed the way we interact with financial institutions. However, it's important to be aware of the potential risks associated with technology, such as cybersecurity threats and data breaches. Always use strong passwords, protect your personal information, and be wary of phishing scams. The firm also cautions that "Morgans website and/or mobile terms, privacy and security policies dont apply to the site or app you're about to visit," so one needs to be cautious.

Consider the importance of long-term financial planning. Investing is not a get-rich-quick scheme. It's a long-term endeavor that requires patience, discipline, and a clear understanding of your financial goals. JPMorgan Chase & Co., through its wealth management services, can help you develop a comprehensive financial plan that takes into account your current financial situation, your future goals, and your risk tolerance. This plan can serve as a roadmap for achieving your financial aspirations, whether it's retirement planning, saving for a down payment on a home, or funding your children's education.

Tax implications are an often-overlooked aspect of investing. Different investment products and strategies have different tax consequences. It's important to understand how taxes can impact your investment returns and to develop a tax-efficient investment strategy. JPMorgan Chase & Co., through its financial advisors, can provide guidance on tax-efficient investing strategies. However, it's always advisable to consult with a qualified tax professional for personalized tax advice. Remember that tax laws are subject to change, so it's important to stay informed about the latest developments. Being aware of these issues in "And its affiliates (collectively jpmcb) offer investment products, which may include bank managed investment accounts and custody, as part of its" offerings is key.

Estate planning is another important aspect of long-term financial planning. Estate planning involves creating a plan for how your assets will be distributed after your death. This can include creating a will, establishing trusts, and making arrangements for the care of your loved ones. JPMorgan Chase & Co., through its wealth management services, can provide guidance on estate planning strategies. However, it's always advisable to consult with a qualified estate planning attorney for personalized legal advice. Having "Morgan private client is a banking and client service offering of jpmorgan chase bank, n.a." can lead to these services.

Philanthropy can be a meaningful way to give back to your community and support causes you care about. JPMorgan Chase & Co., through its philanthropic initiatives, supports a wide range of charitable organizations. You can also incorporate philanthropy into your own financial plan by making charitable donations or establishing a charitable foundation. However, it's important to consult with a qualified financial advisor and tax professional to ensure that your philanthropic activities are aligned with your financial goals and tax planning strategies. With access to investment services from J.P. Morgan, charitable giving can be incorporated into an overall plan.

Finally, remember that financial planning is an ongoing process. Your financial situation, goals, and risk tolerance will likely change over time. It's important to review your financial plan regularly and make adjustments as needed. JPMorgan Chase & Co., through its financial advisors, can provide ongoing support and guidance to help you stay on track toward your financial goals. By staying engaged and proactive, you can ensure that your financial plan remains aligned with your evolving needs and aspirations. The world of "Other investment products and services, such as brokerage and advisory accounts, are offered through j.p. Morgan securities llc (jpms), a member of" is a complicated one that needs constant review and adjustments.

Detail Author:

- Name : Taya Glover

- Username : smills

- Email : pacocha.lexus@yahoo.com

- Birthdate : 1982-06-21

- Address : 6609 Wisozk Oval North Gladys, NC 53887

- Phone : +15736535177

- Company : Kovacek-Cummerata

- Job : Motor Vehicle Inspector

- Bio : Et laboriosam consequuntur quia sint. Eum et sequi error labore eius delectus quia. Qui autem aliquid voluptatum dolor quia.

Socials

instagram:

- url : https://instagram.com/vwisoky

- username : vwisoky

- bio : Ut sunt possimus ipsa neque. Ut voluptates illo animi similique ut.

- followers : 5346

- following : 1791

tiktok:

- url : https://tiktok.com/@vergie.wisoky

- username : vergie.wisoky

- bio : Vel quis odit ut beatae aperiam molestiae iure.

- followers : 4048

- following : 422

facebook:

- url : https://facebook.com/vergie_wisoky

- username : vergie_wisoky

- bio : Qui quos voluptas rerum consequatur et omnis.

- followers : 1785

- following : 1515